Yearly Archives: 2024

Teaching kids about finances is very important for parents. Why? Well, money skills are like seeds. If you plant them early, you can see them grow into strong, smart habits. Kids learn to plan for the future, realise the value of money, and build responsibility. These skills are prudent to help your kids learn big…

Emergency financial needs can arise without notice and individuals often find themselves in need of quick and accessible solutions to meet their requirements. In such scenarios, instant personal loans become the most practical and convenient choice. Unlike other types of loans, the process of obtaining funds through instant loans is quicker and streamlined and proves…

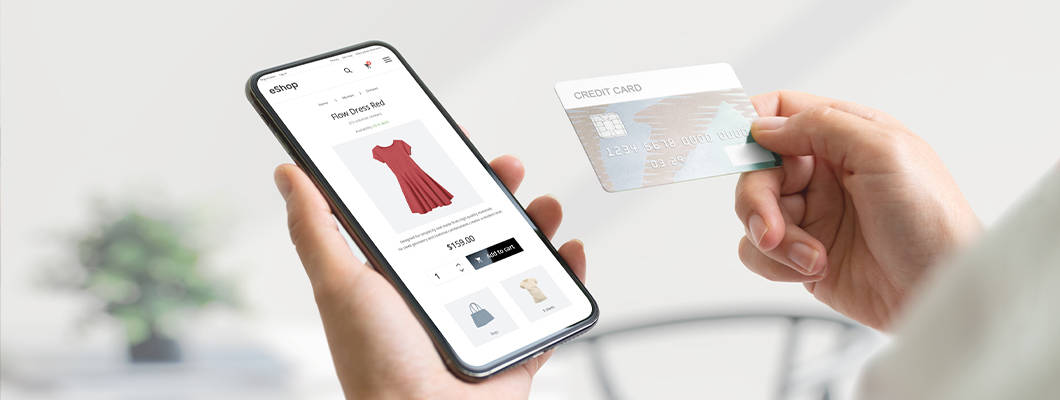

Shopping online has become increasingly common in India over the past decade as more people have access to the internet on smartphones and computers. While online shopping provides convenience, it also involves using payment methods like credit cards that need to be handled responsibly. This guide provides tips on making the most of credit cards…

Credit cards have become an indispensable tool in personal finances as they provide numerous benefits. Among various expenditures, utility bills occupy a recurring and significant position. Leveraging credit cards for utility bill payments not only streamlines the payment process but also enables financial flexibility and convenience. Let’s explore the features and benefits of some of…

Credit cards have become an indispensable tool in personal finances as they provide numerous benefits. Among various expenditures, utility bills occupy a recurring and significant position. Leveraging credit cards for utility bill payments not only streamlines the payment process but also enables financial flexibility and convenience. Let’s explore the features and benefits of some of…

Offers

Offers Rates

Rates Debit Card Related

Debit Card Related Credit Card Related

Credit Card Related Manage Mandate(s)

Manage Mandate(s) Get Mini Statement

Get Mini Statement

categories

categories Bloggers

Bloggers Blog collection

Blog collection Press Release

Press Release