Yearly Archives: 2024

A bearer cheque is a financial instrument payable to anyone who presents it at the bank. Unlike other types of cheques, a bearer cheque does not need the endorsement of the person to whom it is issued. This makes it easy to transfer. Let’s learn more about the meaning of a bearer cheque and its…

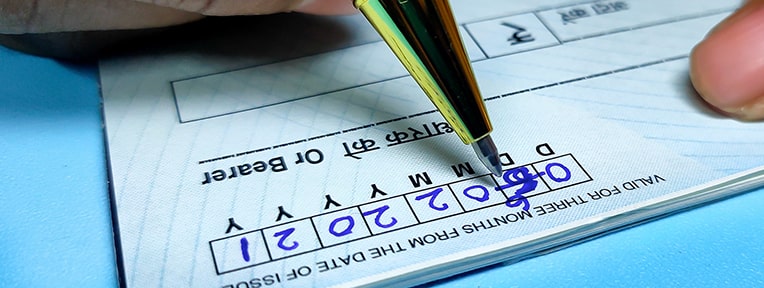

When you join a new employer’s payroll or apply for a loan, you must promptly provide your bank details. A cancelled cheque can simplify this process. It is a common financial document used for verification with no validity for transactions. Let’s explore what a cancelled cheque is, how to write one, and where it is…

When you write a cheque, you expect it to reach the right hands. However, imagine you lose the cheque or that it falls into the wrong hands. The thought of someone else potentially being able to cash can be stressful. This is where a crossed cheque comes into play. A crossed cheque can be identified…

DICGC stands for Deposit Insurance and Credit Guarantee Corporation. The DICGC was established in 1978 as a wholly owned subsidiary of the Reserve Bank of India (RBI). Its main aim is to provide insurance coverage to depositors. It ensures that their deposits are protected in the event of a bank’s failure. SO, let’s learn more…

There are plenty of everyday situations where people need to update their name in a bank account. It’s not just about paperwork—it’s about making sure your financial records reflect who you are. Common Reasons for Name Change Here are a few common reasons: Marriage or Divorce: A change in marital status often leads to a…

Offers

Offers Rates

Rates Debit Card Related

Debit Card Related Credit Card Related

Credit Card Related Manage Mandate(s)

Manage Mandate(s) Get Mini Statement

Get Mini Statement

categories

categories Bloggers

Bloggers Blog collection

Blog collection Press Release

Press Release