Yearly Archives: 2017

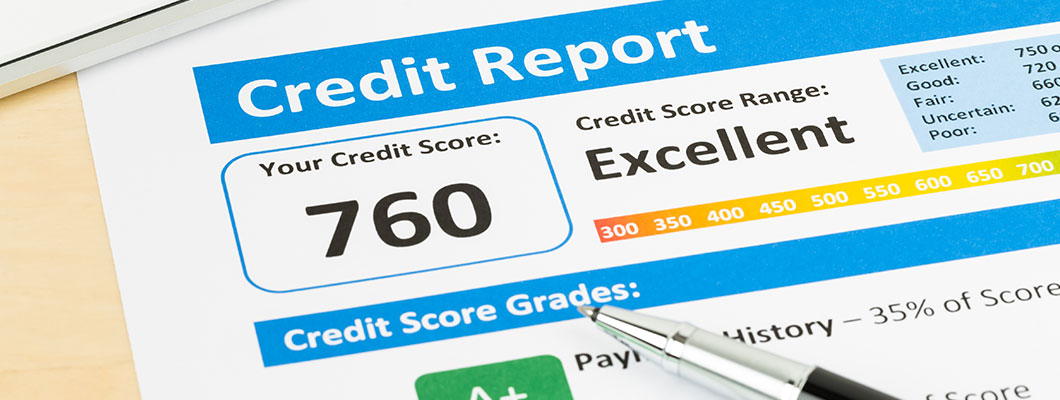

One can’t predict when a sudden need for funds might arise. It is, therefore, advisable to keep your credit record spotless. A bad credit/CIBIL score, arising from late payment or non-payment of credit card bills, can severely hamper your attempt to procure a personal loan. However, having a good CIBIL score will considerably improve your…

Taking a personal loan comes with the obligation of repaying the amount in fixed monthly instalments over a decided period of time. If you fail to repay on time, however, you are liable to pay penalties for late payment, which nullifies the benefits of availing a personal loan in the first place. In addition to…

Very few people think about saving for retirement in their 20s. This can be due to pre-existing student loans which they have to pay off, or they are simply not earning enough. However, by your 30s, saving should not be an afterthought, but a priority. Aside from life insurance, you need a little more security…

Your twenties are a tumultuous time. You are out of college, you probably have your first job, and you are finally coming to terms with the fact that you need to manage your money. While you are going to be tempted to spend excessively, it is going to cost you in the long run. Saving…

If you think that applying for a credit card is a complicated and time-consuming affair, we are here to prove you wrong. With IndusInd Bank, you can now apply for and receive the credit card of your choice from the comfort of your home, or even on the go. What’s more, IndusInd Bank’s hassle-free online application…

Offers

Offers Rates

Rates Debit Card Related

Debit Card Related Credit Card Related

Credit Card Related Manage Mandate(s)

Manage Mandate(s) Get Mini Statement

Get Mini Statement

categories

categories Blog collection

Blog collection Press Release

Press Release